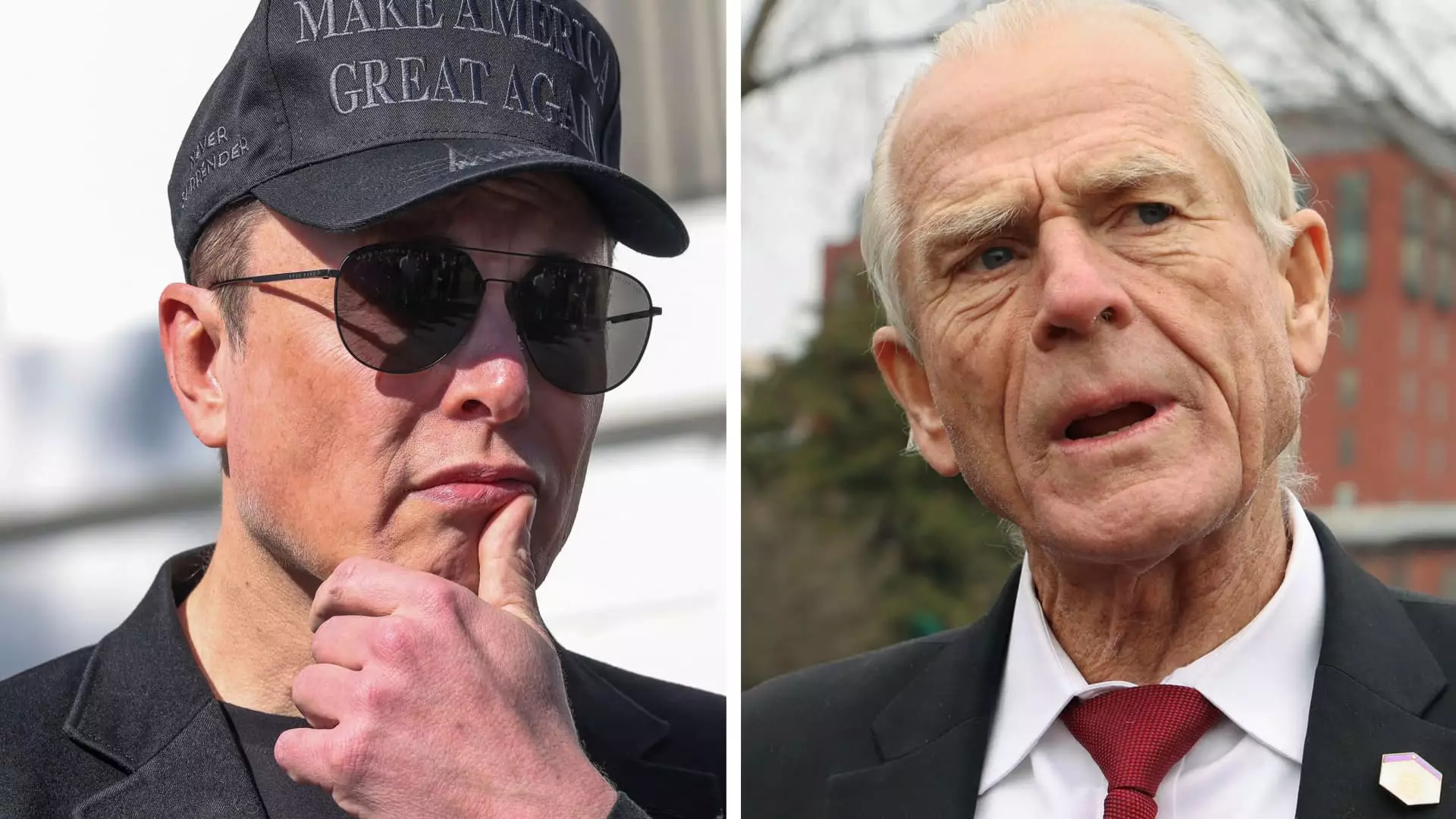

In a remarkable display of animosity, Tesla’s CEO Elon Musk has engaged in a fierce public confrontation with Peter Navarro, a prominent trade advisor to former President Donald Trump. As Tesla’s stock price suffers consecutive declines, Musk’s frustration spilled over into the digital arena, where he unleashed derogatory remarks targeting Navarro and his credentials. This uncharacteristic outburst not only reflects Musk’s personal sentiments but also sheds light on the precarious state of Tesla amidst a tumultuous landscape of trade policies. The implications of Musk’s comments reach far beyond mere insults; they expose vulnerabilities within the automotive industry that are becoming increasingly prominent as economic pressures mount.

Musk’s choice of words—describing Navarro as “truly a moron” and “dangerously dumb”—highlights the seriousness of his convictions. However, this seems less about personal disdain and more about his existential concerns regarding Tesla’s future. The dire state of the stock market, where Tesla shares have plummeted by 22% in just four days, has intensified the stakes of the conversation. Musk is well aware that the public’s perception of the company’s health directly correlates with investor confidence, a reality that likely triggers his emotional responses in the face of immense pressure.

The Context of Conflict

The backdrop to this volatile scenario is a wave of tariffs that Nicola’s administration has ushered in, which pose real threats to Tesla’s operational viability. Although some analysts previously suggested that Tesla could survive the impact of tariffs better than competitors due to its domestic assembly, the reality is that increased production costs are bound to create ripple effects throughout the supply chain. The reality of tariffs on essential materials from countries like Canada and Mexico only amplifies the challenges Musk faces. Musk has been vocal about his desire to foster a zero-tariff environment between Europe and North America—a stance that starkly contrasts with the administration’s current trade policies.

Encouragingly, Musk’s perspective aligns with his business interests. Tesla’s sprawling factory in Berlin demonstrates his commitment to the European market, and it stands to benefit from more lenient trade relations. However, the trends at home indicate that while Musk engages in rhetorical battles, tangible challenges are looming that threaten Tesla’s market share and profitability. The disconnect between business objectives and political dogma could hinder innovation and growth if not alleviated promptly.

Stock Market and Business Performance: A Dire Landscape

The numbers tell a grim tale for Tesla. Following reports of a significant year-over-year drop in first-quarter deliveries by 13%, investor sentiment has wavered dangerously. Compounding these difficulties, Tesla’s stock performance has deteriorated to its worst quarter in over a year, signaling deeper troubles within the organization. Musk’s wealth, intricately tied to Tesla’s market valuation, evaporates in tandem with the company’s decline—leading to a staggering loss of more than $585 billion in market value since the start of the year. This staggering decline is not merely a financial setback; it symbolizes challenges in leadership and a potential failure to navigate the storm of economic adversity effectively.

One has to question the efficacy of Musk’s provocative stance. While engaging in a public feud can draw attention, it tends to distract from the pressing issues at hand. As Musk channels his energies into personal jabs, Tesla’s operational strategies and public perception may suffer the consequences. The recent protests and boycotts regarding Musk’s political affiliations further underline the fragility of his public image and the potential for damaging repercussions on the corporation he leads.

Implications for the Future

As Musk grapples with mounting pressures from both the market and detractors, the conflicting dynamics illustrate a critical juncture for Tesla. With notable challenges not only in terms of trade relations but also within its operational strategy, Musk must find a way forward that reconciles his ambitions with the realities confronting the company. Whether he can pivot from personal grievances to meaningful solutions will ultimately determine Tesla’s trajectory in the coming months. The stakes have never been higher, and the world is watching.

Leave a Reply