As Nvidia prepares to disclose its fourth-quarter earnings, Wall Street is abuzz with anticipation. The tech giant’s performance metrics are expected to reveal critical insights into the company’s financial health and future direction. Analysts estimate an adjusted earnings per share (EPS) of $0.84 with projected revenues soaring to approximately $38.04 billion for the quarter ending in January. Such estimations shed light on the dramatic growth Nvidia has experienced, positioning the company at the forefront of the rapidly evolving artificial intelligence (AI) industry.

For the full fiscal year, Nvidia’s revenue is expected to exceed $130 billion, reflecting an over 100% surge—a staggering feat in a climate where growth can be elusive. With AI becoming central to enterprise technologies, Nvidia’s dominance in manufacturing data center graphics processing units (GPUs) has been pivotal to its success. The demand for these GPUs is closely linked to the burgeoning AI application market, fueled by innovations such as OpenAI’s ChatGPT.

To contextualize Nvidia’s ascent, one must recognize the stock’s impressive trajectory over the past two years, with a staggering increase of over 440%. At one point, Nvidia’s market capitalization even eclipsed the $3 trillion mark, affirming its status as one of the most valuable companies in the U.S. Nevertheless, this remarkable growth has experienced a plateau in recent months. Nvidia’s stock is currently trading at levels similar to those seen last October, raising eyebrows among investors who are questioning the sustainability of its rapid ascent.

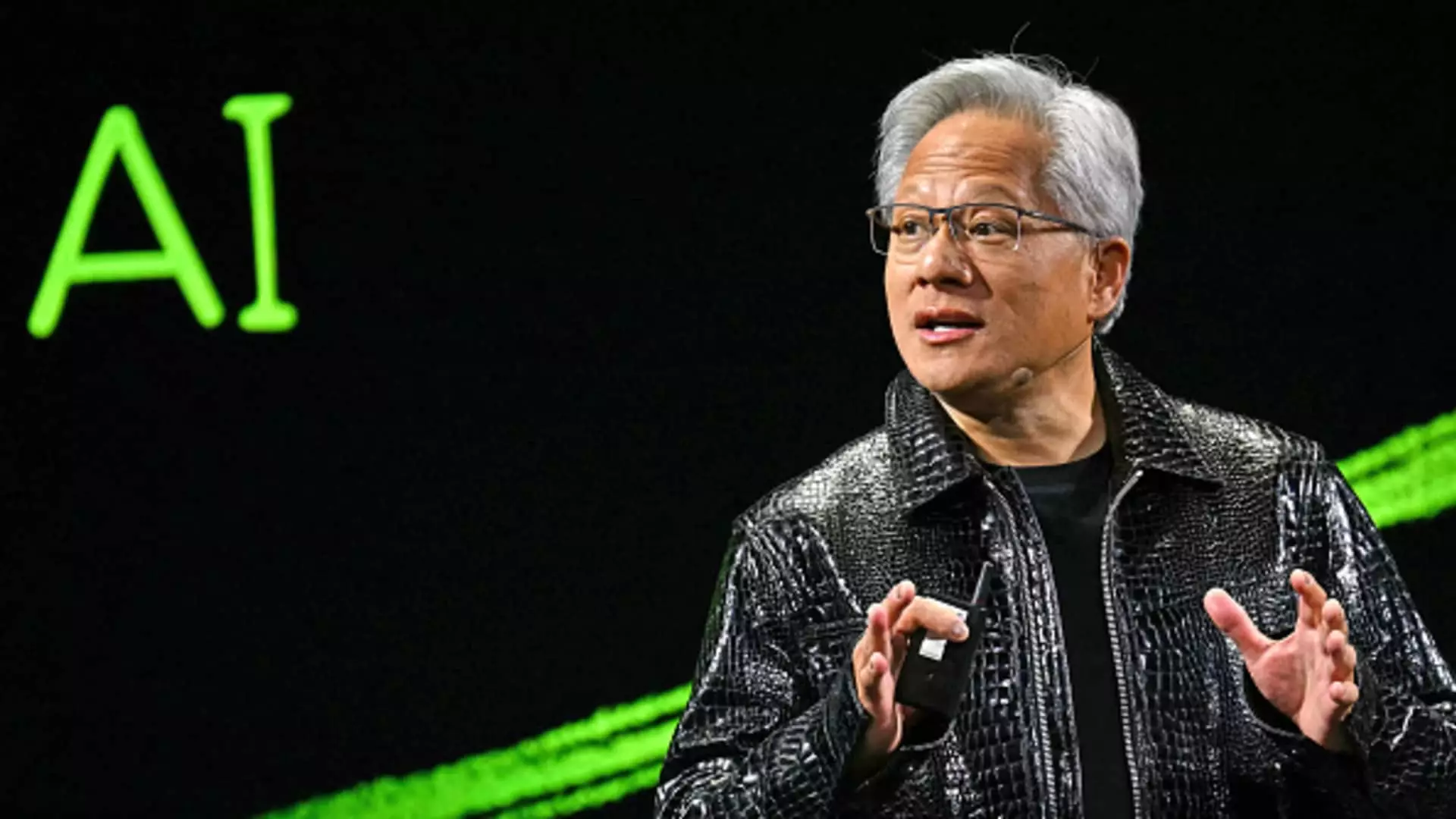

This reluctance from the market is exacerbated by significant uncertainties surrounding the company’s future growth potential. Among those uncertainties are concerns regarding the spending behaviors of hyperscale cloud companies—Nvidia’s largest customers. As these players reconsider their capital expenditure strategies following a prolonged period of expansion, Nvidia’s fate may be perilously intertwined with theirs. Analysts and investors alike anticipate Nvidia CEO Jensen Huang’s addressing of these concerns during the earnings call.

An unexpected competitor has also emerged in the form of DeepSeek’s R1 AI model, which raises questions about the necessity of Nvidia chips for developing cutting-edge AI systems. This scenario poses both a business challenge and a regulatory dilemma for Nvidia. There is a growing concern that U.S. government officials may tighten restrictions on Nvidia’s exports of AI chips to China, citing national security. Current restrictions already limit Nvidia’s access to sell its most advanced AI chips to this market, complicating its international strategy.

In light of these potential regulatory hurdles, investors are looking for updates regarding Nvidia’s recent deployment of their advanced Blackwell chips. Reports have surfaced indicating that challenges related to product distribution may hinder the organization’s future production and sales milestones. As industry analysts from organizations like Morgan Stanley monitor these developments, it becomes apparent that Nvidia’s success is intricately tied not just to its technology but also to broader geopolitical factors.

While recent news regarding major clients, particularly Microsoft, has caused some concern—most notably reports of scaling back on data center leases—it is essential to maintain a broader perspective. Despite those reports, Microsoft has reaffirmed its commitment to a substantial $80 billion investment in infrastructure by 2025, suggesting that demand for Nvidia’s products might well persist.

Moreover, other key enterprise players, including Alphabet and Meta, are also making considerable investments, with projections for capital expenditures in the tens of billions. Such trends imply that the underpinnings of AI infrastructure spending remain intact, although caution is warranted as the market evolves.

As Nvidia prepares to share its guidance for fiscal 2026, analysts and investors will keenly await indications of sustained growth amidst uncertainties. The results of this quarter’s earnings will critically shape investor sentiment, informing speculation on Nvidia’s capacity to weather competitive challenges and leverage opportunities in the booming AI landscape. Whatever the outcome, Nvidia’s path forward remains one of significant intrigue and potential risk, underlining the complex interplay between innovation, market demand, and regulatory considerations in shaping the future of tech giants.

Leave a Reply