In an intriguing move, Hertz has begun offering select renters of electric vehicles (EVs) the chance to purchase the cars they have been renting. This initiative appears to align with broader trends in the automotive industry where electrification and sustainability are becoming focal points. What makes this development particularly notable is Hertz’s direct outreach to renters of popular models such as Tesla and Chevy, extending opportunities that are not common in the traditional rental market.

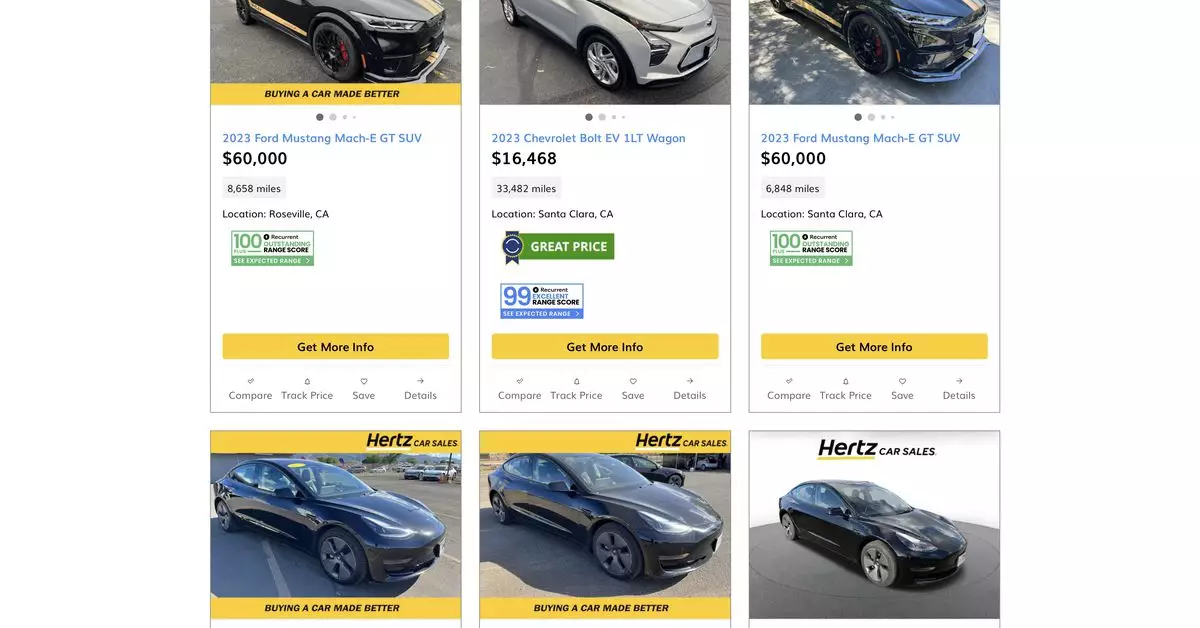

Recently, anecdotal reports surfaced on platforms like Reddit where drivers of Hertz rentals disclosed that they received attractive buyout offers. One individual renting a 2023 Tesla Model 3 was quoted a price of approximately $17,913—a figure that mirrors the listings on Hertz’s own car sales site. This approach seems to make strategic sense not only in enhancing customer experience but also in tapping into the growing interest in electric vehicles.

The pricing offers, while compelling, invite scrutiny concerning the financial implications for both consumers and Hertz. For the renter, acquiring a vehicle with around 30,000 miles at under $18,000 may represent a better deal compared to zeroing in on a standard used car listing elsewhere. For Hertz, however, this approach raises questions about the sustainability of such offers, particularly for vehicles that may require additional maintenance or refurbishment, especially after being exposed to the rigors of rentals.

Interestingly, the complexity of these transactions is underscored by Hertz’s previous initiatives. The rental giant had aimed to position itself as a leader in EV availability but faced hurdles like low consumer demand and repair issues across its fleet, which included models from Tesla and Polestar. This shift indicates a pragmatic reevaluation of strategy, focusing on selling via the rental customer experience rather than solely pursuing an aggressive electrification goal.

Customers considering the buyout option also need to assess the limits of Hertz’s offer. Vehicles purchased under this scheme come with a limited 12-month or 12,000-mile powertrain warranty, which might not provide adequate long-term security for consumers. The implicit risk here is that customers could be left with unforeseen maintenance costs soon after purchase, potentially undermining any perceived value of the deal.

Moreover, the buy-back option available within seven days provides minimal reassurance for those wary of making a hasty decision. This aspect reinforces the importance of thorough evaluation before proceeding with such transactions.

Hertz’s decision to connect rental customers to the potential sale of their rental vehicles represents a blend of innovation and necessity. As the company navigates the challenges posed by fluctuating demand and operational hurdles, this initiative may just be the innovative pivot needed to enhance its market position. As the automotive landscape evolves, so too will consumer expectations, making it critical for Hertz and others in the industry to adapt swiftly and effectively. The ultimate test will be whether this new strategy can foster a sustainable model for both the company and its customers in a rapidly transforming market focused on electric vehicles.

Leave a Reply