The venture capital landscape in the United States is poised for an intriguing evolution as we look toward 2025. A recent report by PitchBook and the NVCA reveals important insights into the potential for unicorns—startups valued at $1 billion or more—to enter the public market. As we analyze these trends, it becomes evident that while optimism prevails, significant challenges remain.

Within the realm of unicorns, numerous companies have been identified as frontrunners for initial public offerings (IPOs) in 2025. According to PitchBook’s Venture Monitor report for the fourth quarter of 2024, firms such as Anduril, a defense technology company founded by Palmer Luckey, and Mythical Games, a Web3 gaming enterprise, boast impressive IPO probabilities of 97%. Other noteworthy candidates include Ayar Labs, Carbon, and Databricks. This optimistic outlook highlights a renewed investor interest, particularly in sectors that have shown resilience and growth potential, such as defense and technology.

However, while the numbers suggest a bright future for these companies, the underlying conditions present a mixed bag. The journey from private to public markets is fraught with complexity, and companies will need to navigate the intricacies of valuation and market sentiment carefully.

Central to PitchBook’s analysis is their utilization of machine learning and robust data analytics to predict the likelihood of successful exits for startups. Leveraging its extensive database, PitchBook assigns probabilities to various outcomes, including acquisition, public offering, and failure to exit. The sophistication of such predictive tools is a game-changer, granting stakeholders clearer insights into the startup landscape. Yet, this reliance on technology also raises questions about the unpredictability of market dynamics.

Despite the statistical projections, the venture capital ecosystem continues to grapple with valuation mismatches. Inflated funding rounds from previous years have created disparities between buyer and seller expectations. Companies that were once regarded as top contenders may find themselves at a disadvantage due to these inflated perceptions.

The Regulatory Environment: A Double-Edged Sword

Another pivotal factor in shaping the IPO landscape is the regulatory environment. Insights from Nizar Tarhuni of PitchBook point to a cautious optimism rooted in potential changes to federal oversight. The shifting political winds, including leadership changes at agencies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ), may alter the capital flow into startups. Additionally, anticipated reforms regarding regulations by the Securities and Exchange Commission (SEC) could alleviate some of the burdens on emerging companies.

Yet, these potential improvements do not guarantee a smooth path forward. The balance of supporting innovation while ensuring market integrity remains a significant concern. The ultimate outcome will depend on how well these regulatory changes are implemented and whether they align with the needs of innovative firms.

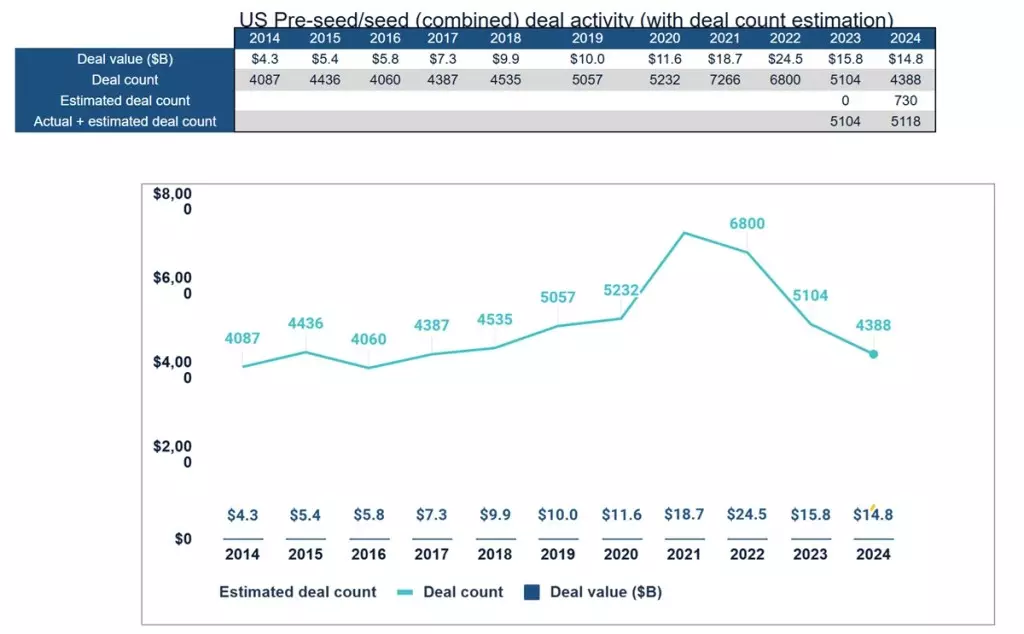

As we examine investment patterns heading into 2025, it’s crucial to note that capital is increasingly being diverted into alternative assets, impacting the venture capital environment. Financing activity appears subdued, with many investors adopting a cautious stance. Bobby Franklin, CEO of the NVCA, echoes this sentiment, highlighting that while past months have seen a spike in investments, the general atmosphere still remains one of wariness.

The competition for investment dollars among emerging managers and established firms heightens the stakes, leading to a potential imbalance in funding distribution. Companies in early stages, particularly, may struggle to attract necessary investments as larger platforms dominate the capital landscape.

Looking ahead to 2025, the landscape for U.S. unicorns is characterized by both challenges and opportunities. The potential for IPOs of robust companies indicates a favorable outlook, yet underlying regulatory and market challenges could hinder this momentum. As the ecosystem adapts to new realities—both in terms of innovative solutions and regulatory navigation—stakeholders must remain agile. The interplay of these forces will ultimately shape the trajectory of venture-backed companies and their role in the broader economic landscape, making it an exciting yet uncertain chapter in the world of startups.

Leave a Reply