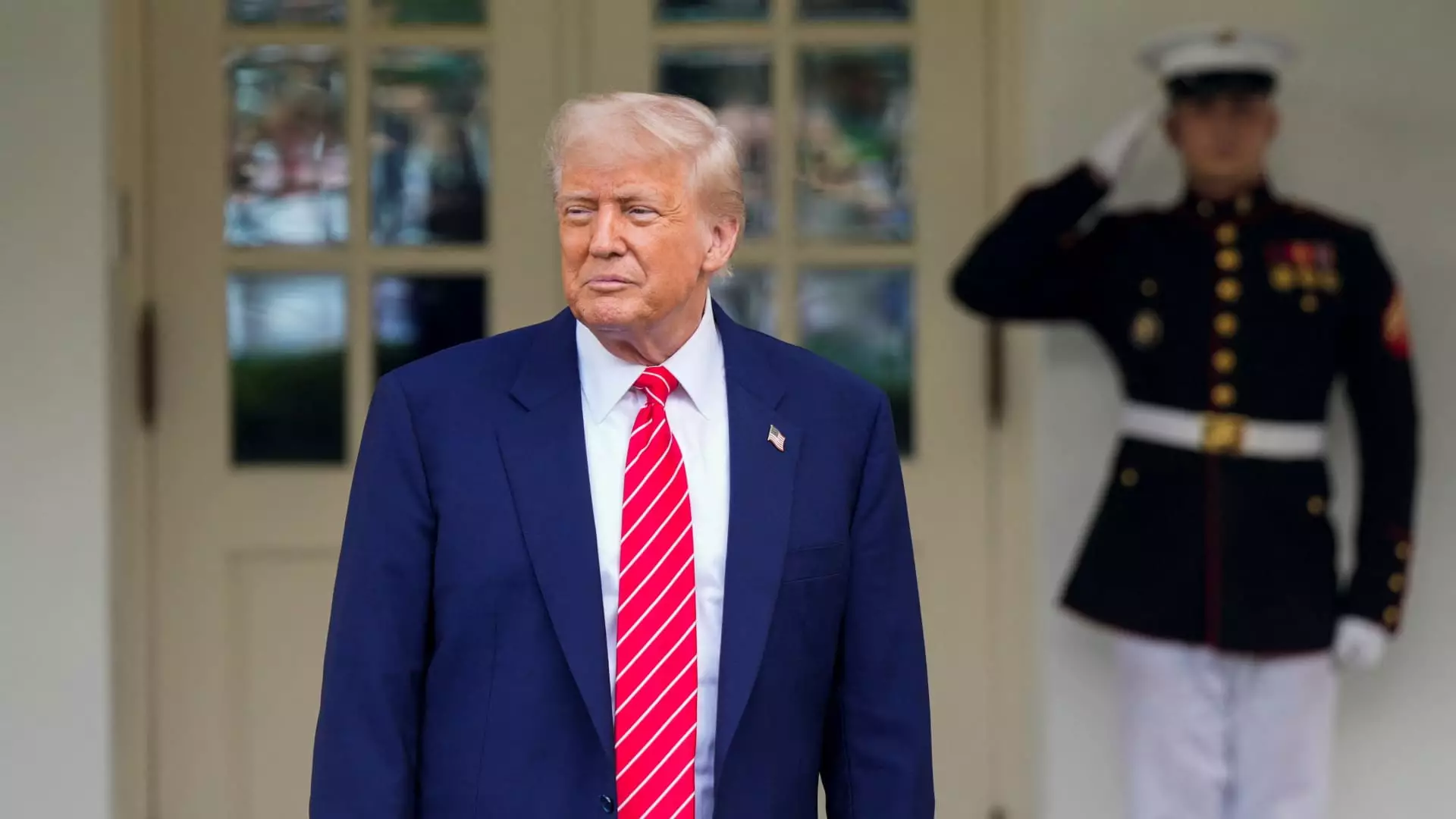

In the realm of politics, conflicts of interest are a pervasive issue that can derail even the most promising legislative initiatives. President Donald Trump’s entanglements with cryptocurrency ventures epitomize this dilemma, as his personal financial interests appear to obstruct critical legislative efforts within Congress. The most recent casualty of this conflict is the GENIUS Act—a bill meant to delineate federal regulations for stablecoins—which faced significant hurdles primarily due to concerns over Trump’s financial activities related to digital assets.

In a striking condemnation, Senator Jeff Merkley (D-Ore.) articulated the implications of these entanglements for the integrity of governance, labeling the situation as a “profoundly corrupt scheme.” The connection between political influence and personal profit is alarming, raising vital questions about the ethical boundaries for elected officials engaging in financial pursuits while in office. The legislative process should prioritize the public good, yet it appears that the current administration is more inclined towards frameworks that support personal enrichment.

The GENIUS Act: A Missed Bipartisan Opportunity

The GENIUS Act aimed not only to provide clarity and regulations surrounding stablecoins—digital currencies pegged to stable assets like the U.S. dollar—but also to create a conducive environment for innovation and safety within the cryptocurrency market. Despite a bipartisan coalition rooting for the bill, it ultimately failed to advance in the Senate due to a narrow 48-49 vote, underscored by the dramatic fallout from Trump’s self-serving crypto initiatives.

When lawmakers from both sides of the aisle were apparently ready to collaborate, the emergence of Trump’s own meme coin, $TRUMP, muddied the waters. The president’s venture, which had generated substantial hype and value—leading to promotions enticing crypto holders with dinners and tours of the White House—illustrates a disconcerting conflation of governance and business that should deeply concern all stakeholders. Trump’s actions indicate a troubling prioritization of personal financial gain over the public interest.

The Democratic Push for Reform

The Democrats, essential in shaping the narrative around cryptocurrency regulation, have reacted robustly to the situation. Alongside the GENIUS Act, they introduced the “End Crypto Corruption Act,” which aims to establish firmer regulations against elected officials and their families selling or endorsing digital assets, a clear response to the perceived threats to democratic integrity posed by Trump’s financial engagements.

Prominent party figures, including Senators Elizabeth Warren and Kirsten Gillibrand, have voiced intense criticism over the intertwining of Trump’s business ventures with national policy. Gillibrand, who initially supported the GENIUS Act, highlighted the necessity for procedural and ethical reforms in the legislative journey: “I believe it is essential to the future of the U.S. economy… that we enact strict stablecoin regulations and consumer protections.” Such statements signal that Democratic leaders recognize the gravity of maintaining a solid and trustworthy framework for cryptocurrency in the U.S.

Industry Perspectives: Frustration Amidst Turmoil

The crypto industry appears caught in a paradox where entrepreneurial spirits could contribute to innovation but are thwarted by the very leadership meant to protect this burgeoning sector. Ryan Gilbert, founder of Launchpad Capital, articulates a perspective resonant with many in the market: “It’s unfortunate that personal business is getting in the way of good policy.” Stakeholders are increasingly demanding a regulatory landscape that fosters growth without fear of coercive entanglements that could distort market dynamics.

The current climate reflects how deeply the Trump administration’s conflicts could impact other legislative pursuits and the reputation of the U.S. as a leader in the global cryptocurrency arena. With influential senators calling for investigations into Trump-affiliated coins, it frontlines the moral imperative for policy and ethics in the increasingly intertwined domains of governance and digital finance.

The Road Ahead: Navigating Ethical Waters

As the cryptocurrency debate evolves, it is evident that ethical governance must take precedence over personal financial interests. The fusion of personal and political does not simply raise eyebrows; it threatens the fundamental tenets of democracy and public trust. Industry leaders continue to call for a framework supportive of innovation, which might only be realized when political figures disengage from the business entanglements that jeopardize legislative progress.

The world is watching as the U.S. campaigns towards cryptocurrency regulation. Whether the next steps taken will signify a transformative approach to governance or perpetuate a cycle of conflict remains a pressing question. As lawmakers, industry stakeholders, and the public grapple with these issues, the necessity for a separate, transparent, and ethical political landscape has never been more evident.

Leave a Reply