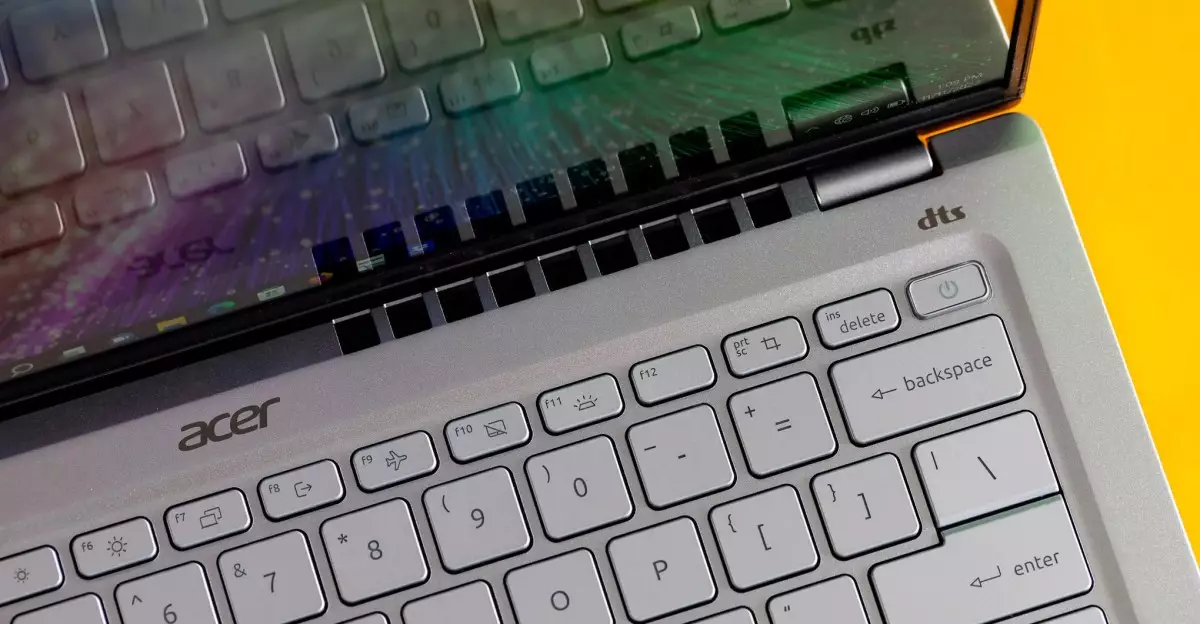

The ongoing trade tensions between the United States and China have prompted significant concerns about the pricing of electronic goods, particularly laptops. Acer’s CEO, Jason Chen, has publicly stated that consumers should be prepared for a price hike of approximately 10% in the United States, effective next month. This prediction stems from the new import tariffs imposed by the Trump administration, which add a layer of complexity to the pricing strategies of tech companies. Given the critical role of laptops in both personal and professional settings, any price increases could have broader implications for consumers and the tech market as a whole.

The business landscape for technology manufacturers is increasingly influenced by international policies, especially tariffs. Chen’s assertion that a 10% increase is likely the default price adjustment highlights how these tariffs are reshaping pricing structures. The tariff situation is particularly pressing as many businesses depend on components and assembly facilities based in China, resulting in potential supply chain disruptions. As Chen noted, while Acer is adjusting its prices due to the tariffs, it has also relocated some of its desktop manufacturing outside of China, illustrating a possible shift in strategy to mitigate rising costs.

Moreover, the discussion around price gouging presents another layer of concern. Chen pointed out that some competitors may leverage the tariffs as justification to implement even steeper price increases beyond the tariff’s impact. This speculation raises ethical questions about corporate responsibility and pricing strategy in times of economic strain. Companies could potentially exploit the situation, risking consumer backlash and long-term brand loyalty.

While Acer is moving forward with its price increase, major players such as Apple, Dell, and HP have remained silent on their pricing adjustments. The lack of immediate response from these companies could indicate a wait-and-see approach or a strategic analysis of the market before making a decision. Additionally, Framework, a newer player with a focus on modular laptops, suggests an interesting deviation from traditional manufacturing norms by partially sourcing its components from Taiwan, thereby potentially shielding itself from the full brunt of the tariffs.

This scenario illustrates the importance of diversifying supply chains, especially in a climate where political tensions may dictate market conditions. As companies evaluate their operational strategies, some may choose to move manufacturing closer to the target markets, thus allowing for greater flexibility and possibly reducing reliance on politics-driven costs.

Looking towards the future, the uncertainty surrounding tariffs and their impact on pricing will likely continue to challenge both manufacturers and consumers. While a 10% price increase may be seen as unavoidable, the potential for price gouging places consumers in a precarious position. In an economy increasingly reliant on technology, businesses must navigate these challenges with an eye towards transparency and fairness in their pricing strategies.

As the tech industry grapples with these issues, consumers should remain informed about their purchasing choices. The interplay of economic policies and corporate decisions will undoubtedly shape the landscape of electronics retail in the coming months, and stakeholders at all levels must adapt to ensure both competitiveness and consumer trust remain intact.

Leave a Reply