In a dramatic shift, President Donald Trump recently backtracked on imposing hefty tariffs on electronic goods, a maneuver that might redeem some investor confidence in the beleaguered U.S. stock market. This decision, unveiled late last night, echoes concerns from various sectors of the tech industry and signals that adhering to established economic advice might be essential for maintaining the vibrancy of the U.S. economic landscape. While the initial scare of 145% tariffs primarily impacting Chinese-made consumer electronics was designed to curb reliance on foreign manufacturing, the fallout presented a much graver consequence — hampering innovation and hindering everyday consumer access to technology.

As an analysis highlighted, the landscape of the American economy, heavily dependent on a thriving tech sector, risks stagnation if such barriers remain. The recent announcement essentially exempts critical components like semiconductors — the building blocks for modern technology — from the tariffs initially slated for enactment. Nevertheless, the apprehension surrounding Trump’s unpredictability in trade relations continues to loom large, leaving many analysts skeptical about the long-term impact of these tariff decisions on investor sentiment.

The Economics of Tariffs: Who Really Benefits?

Prior to this reversal, forecasts indicated that a $1,000 iPhone could skyrocket to an outrageous $3,500 if produced domestically, sparking widespread criticism and fear of decreased consumer spending power. Pundits have warned that elevating tariffs will complicate supply lines further, leading to significant price hikes on various tech products — estimates suggested a 40% increase on gaming consoles, a 26% climb for smartphones, and an astonishing 46% surge for laptops. Such drastic changes could alienate consumers and deter technological advancement, which stands in stark contrast to the administration’s alleged goals of revitalizing the American manufacturing sector.

The tech world is intricately interwoven with global supply chains that span continents, and the reality of losing dominance in chip production has been a long time coming. It took decades for foreign firms to outpace American manufacturers, and reestablishing such market presence will not be an overnight feat, regardless of tariff pressures. Experts, including Scott Almassy from PwC, emphasize that the ripple effects of tariffs manifest earliest in foundational materials such as steel and aluminum, not products that are already priced in a competitive global market.

The Chip Challenge: Beyond Tariffs

While Trump’s administration suggests sectoral tariffs might still be on the table for specific goods like semiconductors, the reality is that tariffs alone won’t rejuvenate the American manufacturing prowess. Companies like Apple have expressed intentions to reallocate some assembly processes back to home soil, yet the timeline for this ambitious transition is daunting — industry insiders hint it could take decades to fully realize these goals. The bipartisan U.S. Chips and Science Act aims to inject capital for domestic chip fabrication, but as Duncan Stewart from Deloitte suggests, even with substantial investment, the movement back toward a dynamic manufacturing industry will be painfully slow.

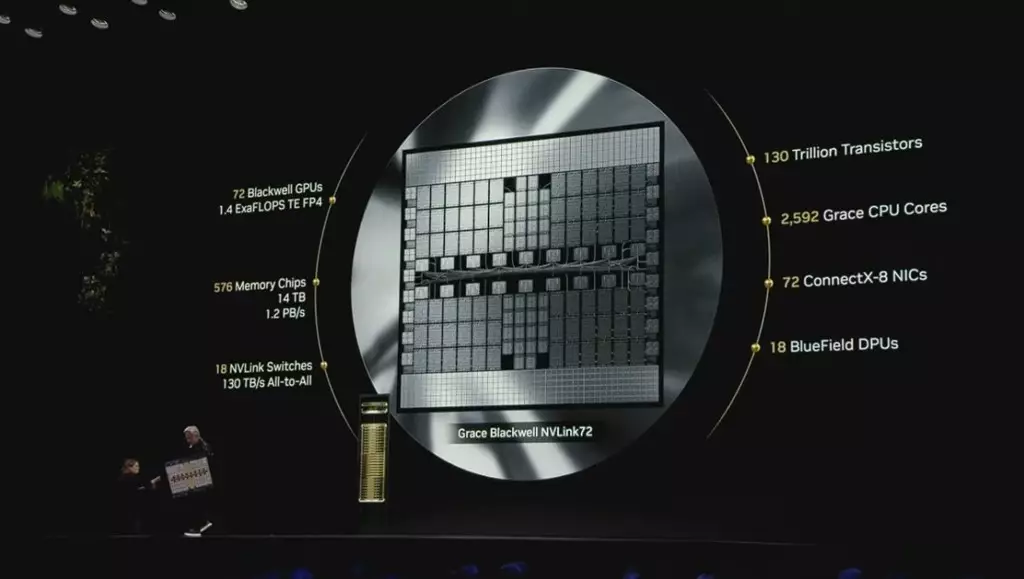

This scrutiny of the semiconductor landscape raises profound questions about our global strategy, especially when considering how companies such as Nvidia have innovated using production facilities in Taiwan, essentially outpacing legacy corporations like Intel. By leveraging external manufacturing capabilities, Nvidia transformed AI and data processing into a significant revenue stream, illustrating that possession of cutting-edge technology and design capabilities matters far more than the physical location of production facilities.

Education and Innovation: The Path Forward

Amid these discussions, an often-overlooked aspect surfaces — the necessity for a robust workforce. The tech industry thrives on highly skilled professionals who require advanced education and specialized training. Unfortunately, this landscape has become increasingly challenging for the U.S. as competitors like China boast rapidly increasing numbers of engineering graduates. With American education in science and mathematics lagging, the administration’s intention to stimulate domestic manufacturing lacks a foundation of skilled labor to support such endeavors.

While politicians express concern over the climbing influence and lobbying power of the tech sector, the undeniable truth remains: this industry cultivates high-paying, high-skill jobs pivotal for economic prosperity in the modern era. The importance of fostering educational reform and prioritizing STEM fields cannot be overstated if we are to regain lost ground in global competitiveness.

In the backdrop of these developments, a spokesperson for Trump stated the country could not afford to lean on China for pivotal technological advancements. The ongoing dialogue illustrates a complex matrix of needs, opportunities, and challenges that lie ahead for the U.S. economy. As can be seen, tariffs may reposition certain factors temporarily, but the real solution relies on investment, education, and innovation that extend well beyond the borders of trade agreements or tax policies.

Leave a Reply