In the ever-evolving landscape of retail technology, few stories are as illustrative of the challenges faced by ambitious startups as that of Grabango. Launched in 2016, the Berkeley-based firm emerged as a contestant in the cashierless checkout race, pitting itself against giants like Amazon. Grabango’s innovative technology aimed to revolutionize shopping experiences through computer vision and machine learning, allowing customers to waltz out of stores without the need for traditional checkouts. However, despite establishing itself as a potential leader in this burgeoning field, Grabango’s dream has met an untimely end, revealing the harsh realities of venture-backed startups in a competitive technology market.

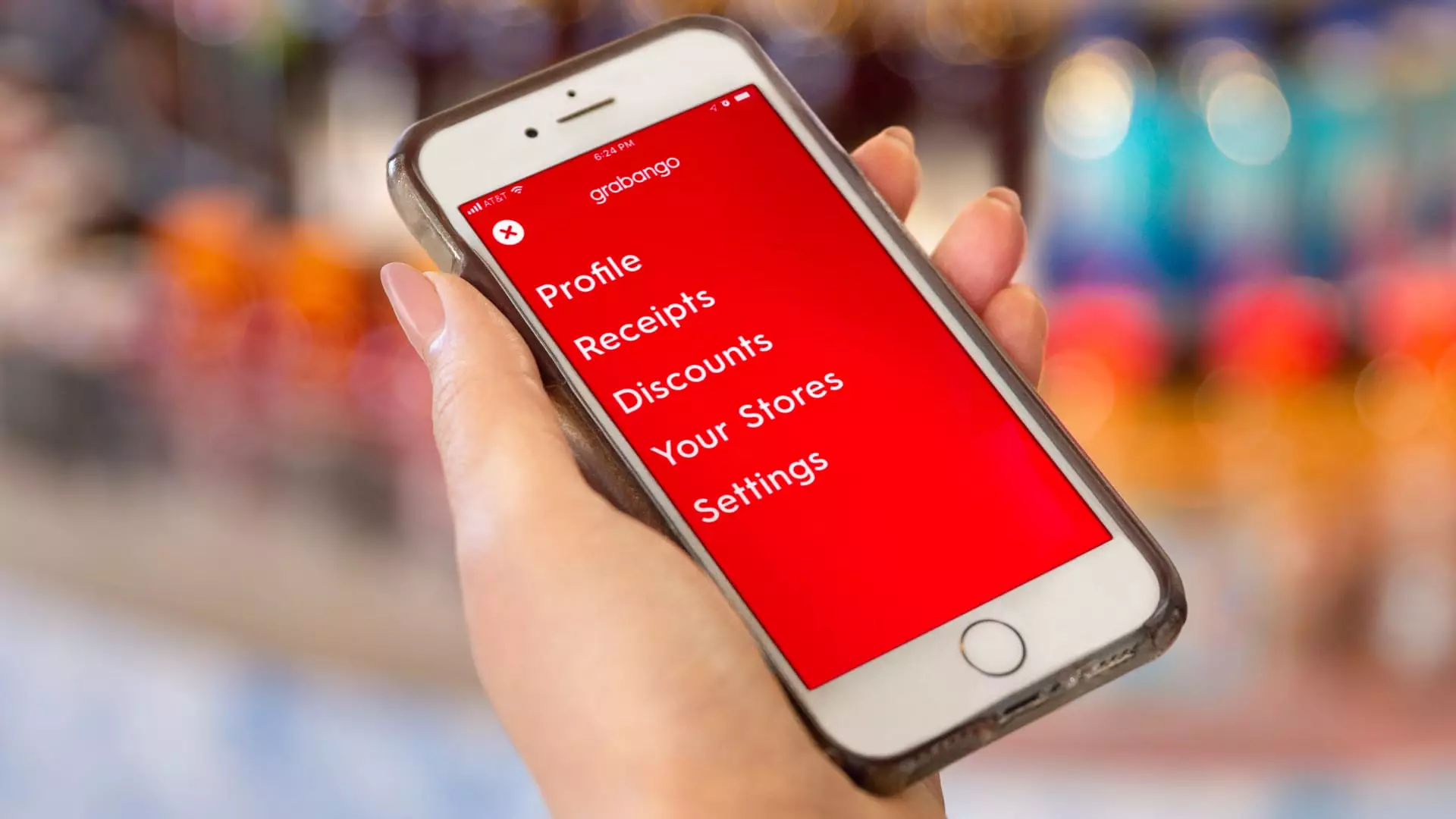

Grabango’s platform allowed shoppers to select items and leave the store without a conventional payment process. This checkout-free technology was heralded as a breakthrough, attracting attention from established retailers. The company secured partnerships with grocery and convenience store chains such as Aldi, Giant Eagle, 7-Eleven, and Circle K. However, innovation alone did not suffice to keep the company afloat. Despite raising over $73 million from investors, the lack of further funding proved detrimental as it faced an increasingly challenging financial environment marked by a slowdown in the IPO market and diminished venture capital liquidity.

The competitive landscape significantly shaped Grabango’s fate. Amazon’s cashierless technology, known as Just Walk Out, became a notable benchmark in the industry. While Grabango eschewed shelf sensor technology and embraced a strategy centered on computer vision, Amazon capitalized on its extensive resources and market presence. Grabango positioned itself as the underdog, promoting an alternative approach to cashierless shopping. Nevertheless, the broader challenge of securing consistent funding was compounded by a downturn following 2021, when Grabango achieved its most substantial investment round, primarily focused on pre-IPO ambitions.

Grabango’s eventual closure highlights a sobering truth about venture capitalism, where the initial promise of innovation can be eclipsed by the dire need for sustainable financial backing and strategic market penetration. Will Glaser, the founder and CEO, initially projected a lofty attainment of a $10-15 billion market cap and hinted at a potential IPO within a few years. However, market conditions turned unfavorably, leaving innovative firms like Grabango grappling with dwindling investor interest. The overall decline in liquidity within the venture ecosystem posed critical obstacles for startups unless they fell within the still-favored categories, such as artificial intelligence.

A critical examination of Grabango’s trajectory provides insights into common pitfalls for ambitious startups. Ultimately, Grabango faced two primary challenges: the inherent unpredictability of technology funding and the fierce competition with established players. Its reliance on breakthrough technology may have been its strongest suit, yet without a robust financial strategy to accompany its innovations, the company faced insurmountable odds. Furthermore, the reluctance of investors to back non-AI ventures in a climate replete with economic uncertainty rendered Grabango’s plans for expansion and adoption painfully unrealistic.

The narrative of Grabango emphasizes that innovation rooted in technology must walk hand in hand with strategic financial planning and market adaptability. As the venture-backed startup bids farewell, it leaves a critical lesson regarding the volatile nature of retail technology startups in a crowded marketplace. With its closure, the future of cashierless technology continues amidst uncertainty, leaving many wondering: will the dream of checkout-free shopping become a mainstream reality, or will it remain a tantalizing concept continually overshadowed by market dynamics?

In the wake of Grabango’s closure, industry stakeholders must ponder the evolving landscape and consider the balance between ambition and reality, innovation, and sustainability. After all, in the race of retail technology, it appears the tortoise may need to strategize better if it hopes to endure against the hares of the industry.

Leave a Reply