Australia’s ambitious journey towards becoming a leader in low-emissions technology hinges on the effective production and utilization of hydrogen. The newly unveiled National Hydrogen Strategy, championed by Federal Climate Change and Energy Minister Chris Bowen, aims to position Australia as a global frontrunner in green hydrogen production. This strategy seeks to address key obstacles while reinforcing the nation’s commitment to a net-zero future. However, it warrants a critical examination to elucidate the potential challenges, industry dynamics, and strategic implications involved in realizing its goals.

The current strategy marks a significant evolution from the inaugural National Hydrogen Strategy introduced in 2019 under former Chief Scientist Alan Finkel. While it builds upon the foundational principles established in the first iteration, it reflects a shifting landscape shaped by technological advancements and competitive pressures in the global energy market. The emerging questions regarding the practicality and coherence of the new strategy raise valid concerns. In particular, the ambiguity surrounding the relationship between this updated strategy and existing regulatory frameworks warrants close scrutiny.

The previous strategy’s target metrics—specifically, producing hydrogen at a cost below $2 per kilogram—became increasingly impractical, given the substantial challenges associated with hydrogen transport and storage. This strategic misalignment necessitated a refreshed approach that embraces realistic production goals while ensuring the economic feasibility of hydrogen as a renewable energy source.

Hydrogen is celebrated as a versatile and potentially game-changing element that could transform various sectors, including steel production and chemical manufacturing. The production of green hydrogen, generated through renewable energy processes that split water molecules, offers a pathway toward decarbonizing traditionally fossil fuel-reliant industries. The current strategy’s ambitious production targets—aiming for 500,000 metric tons by 2030 and 15 million tons by 2050—signal a commitment to scaling up this nascent industry.

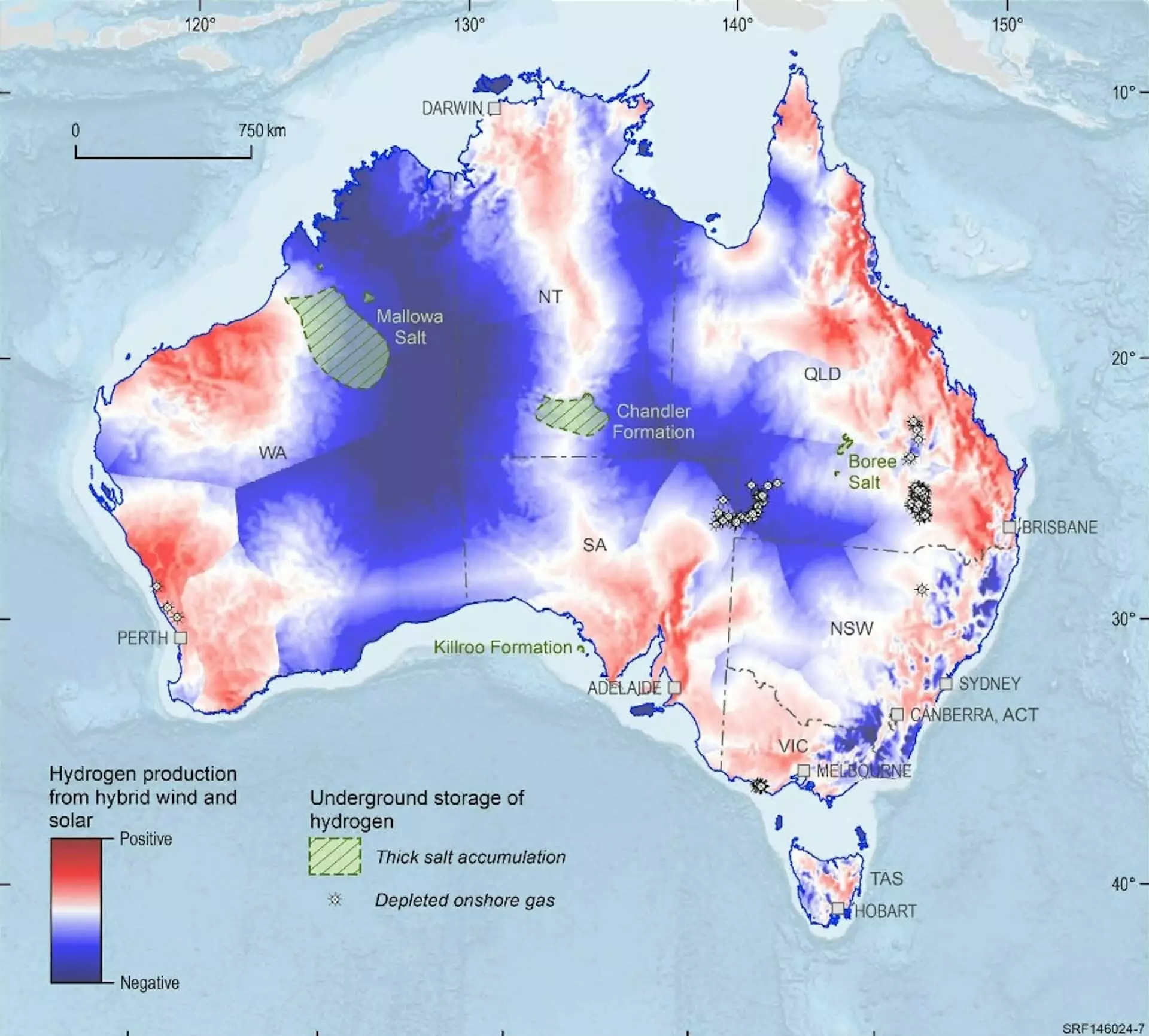

However, it is essential to contextualize these objectives: such scaling will necessitate a robust infrastructure capable of addressing hydrogen’s unique transportation and storage requirements. The government’s aspirations to position green hydrogen as a leading export commodity hinge on successfully identifying viable markets, primarily focusing efforts toward European buyers as Japan and South Korea shift their attention elsewhere.

Significantly, the strategy emphasizes three specific industries—iron, alumina, and ammonia—as the primary sectors where hydrogen can catalyze notable emissions reductions. Notably, this pivot reflects a recognition of the technical limitations and economic hurdles associated with broader hydrogen applications, such as in passenger vehicles and residential heating. The practicalities of adopting hydrogen technology in these realms often fall short of competing with the rising viability of direct electrification through batteries.

Moreover, there exists an evident tension within the strategy between fostering home-grown industries and pursuing export opportunities. While the document articulates clear objectives for developing domestic hydrogen use, it does not expressly preclude the exportation of liquid hydrogen. As such, a well-founded deliberation around prioritization should be made, especially as investment resources remain finite.

In this new strategy, the significance of cultivating community acceptance takes center stage. Amid rising concerns regarding the safety of hydrogen—an inherently volatile gas—the emphasis on thorough engagement with local communities, particularly Indigenous populations, is a progressive step. Addressing sociocultural contexts can mitigate fears and promote a more inclusive conversation regarding hydrogen technology implementation.

Moreover, considering environmental impacts—including water management—is critical. The necessity for a balanced approach that harmonizes the aspirations of a green hydrogen economy with the preservation of natural resources cannot be overstated.

As Australia embarks on this ambitious undertaking, a well-defined framework for assessing progress becomes integral. With a 2029 review date set for the hydrogen strategy, stakeholders should remain vigilant in monitoring key indicators: the financing and construction of large-scale hydrogen projects, the establishment of multi-year supply agreements with consumers, and investments in requisite renewable energy sources.

While the current strategy sets a foundation for innovation and progressive energy transition, realizing its full potential will necessitate clarity and decisive action from governments regarding the funding and support of hydrogen technologies. In an evolving energy landscape, establishing clear priorities and phasing out ineffective projects must be crucial to ensuring public resources are judiciously deployed.

Australia’s hydrogen future is filled with promise, yet fraught with complexities. The successful navigation of this multidimensional landscape will ultimately require collaboration among governments, industries, communities, and investors. Without this collaborative effort, the lofty aspirations set forth in the National Hydrogen Strategy may remain aspirational rather than transformational.

Leave a Reply